You’ve got a beautiful, cozy place in the London suburbs that you want to rent out. You go to Airbnb to list your property, but you suddenly hesitate. What if, by some freak of nature, some accident happens? What if the guests trash your place — or don’t show up at all?

Luckily, Airbnb “embeds” a Host Protection Insurance and Host Guarantee in your property when you sign it up on their platform. These give you additional coverage apart from your own personal, renter’s, or homeowner’s insurance.

Another relatable example is Tesla. Auto insurance is offered at the point of sale online, or when purchasing a Tesla car at a showroom. You can even purchase the policy in as little as one minute!

In insurance, the best kind of digital customer experience is to offer services exactly where and when the customer needs them most. By partnering with the right insurance carriers, companies like Airbnb and Tesla stay present at the right moment for their customers. It’s no wonder that it’s expected to be a US$3-trillion market by 2023! That’s tons of opportunities for insurers and brands!

Embedded Insurance: An Innovative Insurance Technology (InsurTech) Trend

Many companies are catching on to this trend. It’s under the umbrella of embedded finance, one of the FinTech trends where financial services are integrated into non-traditional products, services, and technologies.

They call it “embedded insurance” — leveraging technology to integrate insurance solutions into the customer journey. For customers, it means getting insured at the touch of a button. For businesses, it’s paving new ways to attract and retain customers.

While most businesses already use the web and mobile as their insurance product’s distribution channels, there’s tremendous opportunity to further expand them by “embedding” products and services into the customer’s daily life — when booking a flight, shopping online, and taking an Uber ride, to name a few. Amazon, Shopify, and Apple have even jumped on the bandwagon, too.

Let’s take another example: QuickBooks, an accounting and financial management software provider. Last year, they launched QuickBooks Insurance to provide small and medium businesses insurance coverage. The formula makes sense:

- They’re already managing their customers’ finances and business operations, and their customers obviously need it.

- They already have an established distribution channel to embed their insurance product into.

- They have enough data to understand their customers and can be present at the right place and at the right time.

So how did QuickBooks manage to do it? After all, they’re a software provider, and creating an insurance company overnight is impossible.

The solution: application programming interfaces (APIs). QuickBooks partnered with reputable insurers, AP Intego, Coterie, Cover Genius, and Next Insurance. QuickBooks used APIs and B2B2C platforms and accessed relevant data to offer tailored insurance services. Their clients can easily and conveniently access their insurance policies in a tab within the software and enroll their employees within minutes.

Why Embedded Insurance?

Embedded insurance brings these benefits to insurers and brands or businesses alike:

- Provide an all-inclusive solution to users. Businesses can deliver an end-to-end digital customer experience while improving retention and loyalty.

- Speed up time to market. Businesses can launch products and services faster by using existing insurance platforms.

- Add new ways to generate business. Insurers can expand their distribution channels and identify opportunities and markets where demands are unmet.

Personalize digital customer experience. Insurers can leverage data to know their customers better. This helps insurers provide a contextually relevant customer experience and thus improve conversions.

Insurance as a Service: A SaaS Business Model

A way to support an embedded insurance strategy is to package it “as a service.” These “insurance as a service” models become SaaS platforms that use transactional APIs. They also use other technologies to integrate customizable and real-time digital insurance solutions to the partner’s ecosystems. This includes native mobile apps, websites, web apps, and other online channels.

In Singapore, there’s AXA’s Affiliate Marketing Program that allows partners to use AXA’s app APIs. This is currently used by the Scoot TigerAir, PropertyGuru, and Carousell. AXA has something similar for travel bloggers and media outlets in Europe, letting them embed travel insurance with just a handful of codes.

In Europe, there’s Wakam, a digital insurance provider. Wakam has APIs that developers can work with so businesses can design and offer different kinds of insurance products — from insuring Yamaha motorcycles to electronic gadgets.

All these are what makes embedded insurance one of the innovative InsurTech and Fintech trends shaping the insurance industry today. Traditionally, insurance products and services are distributed and coursed through brokers, agents, or even websites and apps. They’re also an entirely separate part of the process involving a lot of legwork and paperwork.

Embedded insurance disrupts this paradigm. It brings insurance products and services closer (or directly) to partners and customers and embedding them into the customer journey.

Embedded Insurance: API Integration and Modernizing Legacy Systems

Embedded insurance is driven by technology. Implementing it as a strategy requires using infrastructures, technologies, and tools that enable it — namely, an API-first, microservices-based, and mobile-ready architecture.

API-First Approach to Digital Insurance

Adopting an API-first approach means everything about your products or services will be consumed or accessed through different devices, channels, and platforms. Functionalities should be developed in a way that can be exposed as a future-proof, reusable, and consistent API. You’ll need a decoupled architecture that can cater to each touchpoint while providing a consistent user experience.

An API- and microservices-based infrastructure helps you accomplish that. You can modularize your core capabilities and integrate third-party components or services, and they’d all communicate through APIs.

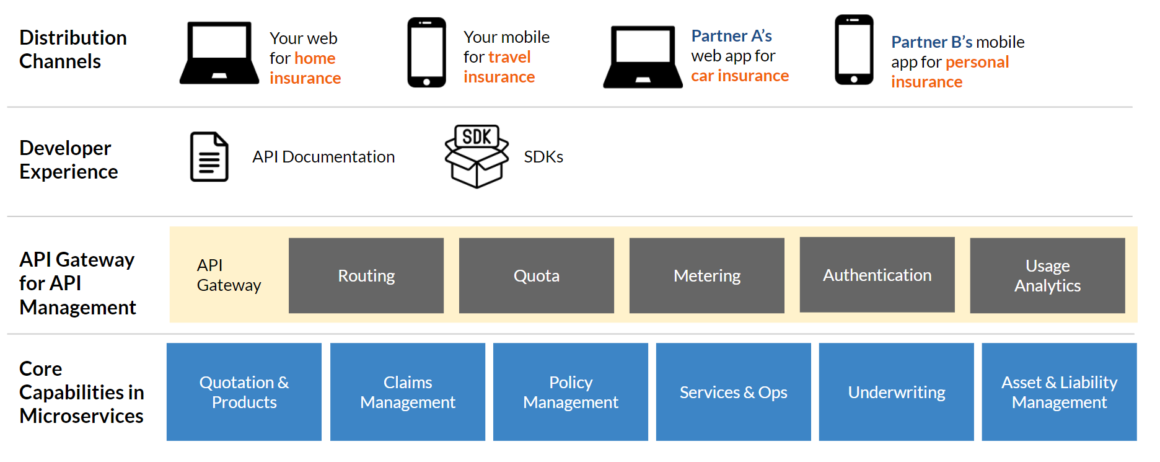

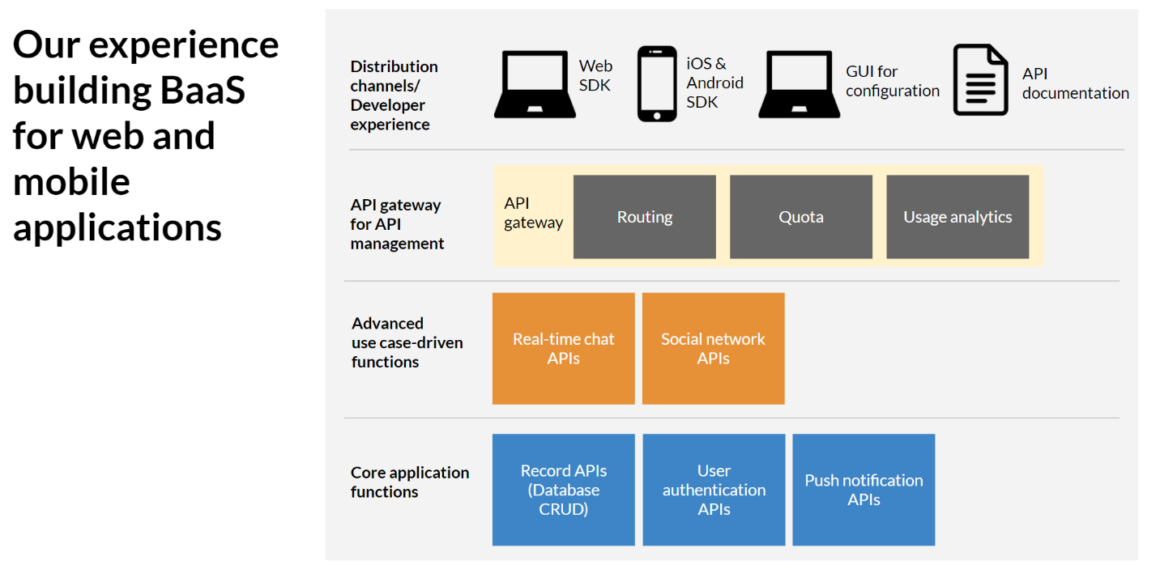

The diagram above shows how an API-first approach would work:

- Distribution channels. These are the front ends that users interact with — desktops and mobile devices, including wearables, internet-of-things (IoT) devices, and web or network applications. In an API-first approach, you have the freedom to create the app in any framework (e.g., AngularJS, React), display different or multiple products and services, and integrate them with a unified logic.

- Developer experience. Well-designed APIs and software development kits (SDKs) have well-defined documentation. They are a reference for developers who use the API and SDK — how it’s intended to behave; its specifications and functions, arguments, classes, and libraries; and examples of code snippets showing how to use it. Properly documented APIs and SDKs help make them more reusable and consistent.

Developer experience (DX) matters for similar reasons as ensuring good user interface/user experience (UI/UX). It decreases the time spent on onboarding your team (or external developers). It also keeps them aligned so they can develop and update faster (i.e., knowing how the API’s resources are exposed).

- API gateway. It sits in front of APIs and acts as an entry point for back-end APIs and microservices. A microservices-based architecture could have 10 to 1,000 or more services, each with its own set of rules. An API gateway is in charge of taking and processing traffic and multiple API calls/requests and routing them to the right microservice.

API gateways also protect the system or infrastructure from abuse by setting quotas and limits to the requests a client could make. They also manage authentication and authorization, letting you manage who can access your APIs and services.

- Microservices. Core business functionalities and processes are modularized into microservices. Because they’re independent from each other, they need APIs to communicate with each other. APIs are also used to expose the service’s data and functionalities to third-party apps or even legacy systems.

In an insurance company’s case, a microservices-based architecture means breaking up core business capabilities into granular services. The insurance products and services are broken down into configurable units stitched together and exposed by APIs.

These either get displayed to the front end, or access back-end apps and components. For example, there’d be one for managing claims; another for maintaining policies; a separate one for underwriting; a different one for calculating insurance quotes, and so forth. Because each service is self-contained, they can be quickly deployed or updated depending on the business need.

If you’re an InsurTech or FinTech startup or scaleup in the UK, you can take advantage of the Open Banking standard. You can create and offer digital insurance products by using shared data, open APIs, and open-source technologies.

A case study would be our work with HL Insurance. We banked on a mobile-first approach to reach the Gen Z and millennial market and improve customer experience. We also designed the mobile apps in a way that can embed insurance products and services to other app features like weather reports and an exchange rate calculator.

Insurance Technology Means Modernizing Legacy Systems

Implementing an embedded insurance strategy is also a digital transformation framework. You can’t provide digital insurance if your systems are not up to par.

There’s a lot of obvious reasons for upgrading IT systems in organization — boosting productivity, reducing costs, and improving digital customer experience.

However, many companies could find it very challenging to do. For one, they may be hampered because of their dependence on legacy systems. They may also be willing, but not know where to start.

In the latter case, we would usually start with the front end, like when we’re creating or revamping a mobile app. By looking at the front end, we’d see if the back end is extensible. This way, we can identify which parts of the underlying architecture need to be modernized. By working on both front and back ends, we can see what APIs are currently used and double check if they are what the front end needs. This is the approach we took for our digital transformation project with Wilson Parking.

When revamping or modernizing IT systems, consider which approach best answers your needs, which could be:

- Replacing or migrating legacy systems (in part or in whole)

- Developing an in-house proprietary system or infrastructure

- Using and customizing commercial, off-the-shelf software

It would also depend on how you work with your legacy systems. As they say, ‘if it ain’t broke, don’t fix it.’ That works in some cases. Generally, we don’t straight out revamp something that’s already running and working. Instead, we explore ways to fix and repair, which is more cost-effective.

An alternative for insurers highly dependent on legacy systems, databases, and applications is to wrap and expose them to new functionalities through APIs.

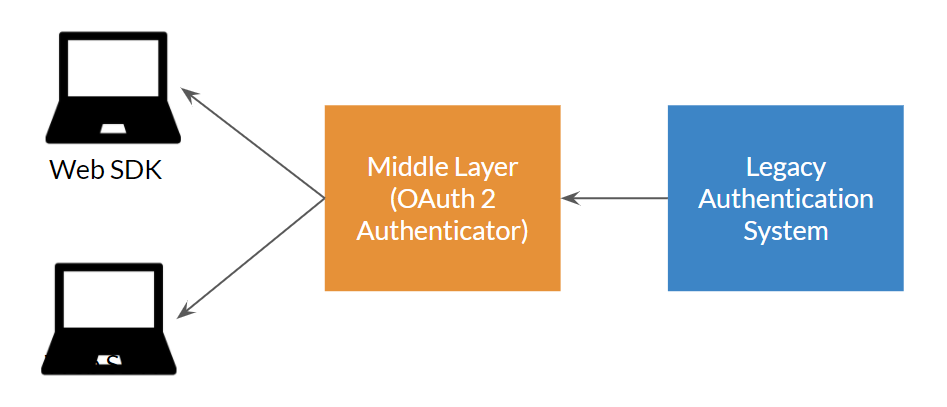

Another example would be our project with a company whose authentication system isn’t extensible, as it’s not using a modern protocol. We didn’t overhaul the whole IT system. Instead, we developed a “middle layer” to bridge the legacy authentication system and SDK.

In any case, you need to carefully review your existing codebase and systems before paving a roadmap to modernize them.

Case Study: Creating a Backend as a Service (BaaS) and SaaS Platform

Over the years, we’ve worked with many companies in implementing API integrations and revamping their legacy systems. As a software development services provider, we have too many projects going simultaneously. It’s become a hassle and time-consuming to create separate back ends for each project with a similar set of features.

We addressed this challenge by developing a BaaS for the web and mobile applications that we build. The BaaS formed a bridge between the app’s front end and various back ends via APIs. By modularizing common app features, developers can simply plug and play services to build production-ready apps. We don’t have to reinvent the wheel! Best of all, this approach saves time and money for our clients, too!

Embedded Insurance: Beyond an API-Based Architecture

An embedded insurance strategy takes more than software development skills to implement. You need the skills to use the underlying technologies and tools required to properly set it up. Here are some must-haves to successfully build an API-based architecture:

- Intuitively designed, easy-to-integrate, and clearly versioned APIs

- Comprehensive API documentations so you can consistently use them

- Well-designed microservices architecture that’s also compatible with legacy systems

- Cloud-native approach (i.e., deploying Kubernetes, working with microservices)

- DevOps (or DevSecOps) to help you reduce the strain and friction when managing multiple services

More importantly, you need the right mindset to go beyond your traditional channels. You need to assess your current capabilities and identify gaps you should improve on (or digitally transform), or opportunities you can take advantage of.

Consumers nowadays have embraced digital interactions. That’s how they mostly want to do business. Insurers can’t ignore this opportunity. A cloud-native, API-first, and modernized IT system will help you be where your customers are.

Oursky works with enterprises and established brands in creating API-first architectures and modernizing IT systems to help with their app/digital product development and digital transformation strategies. Get in touch with us!

Note: We shared our experience and insights on leveraging SaaS as a platform and model for the insurance industry in a webinar hosted by Dupro Advisory last February 19th.

Subscribe to our newsletter for more business and dev hacks!